$450,000

Median Home Price

$375,000

Avg. Loan Amount

478K

Population

35+

Licensed Lenders

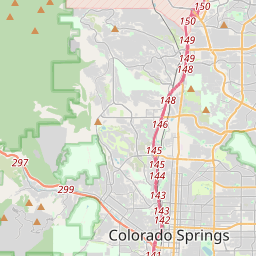

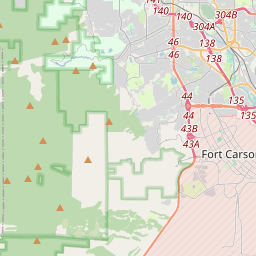

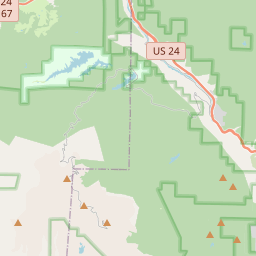

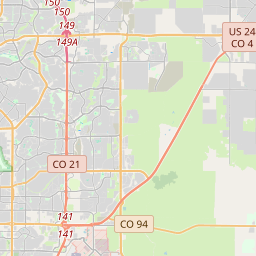

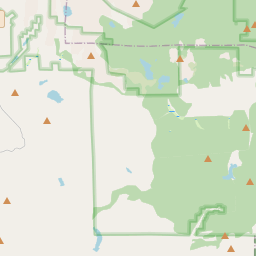

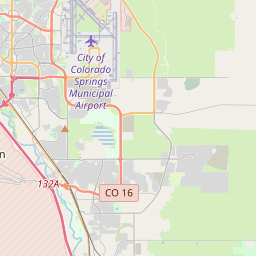

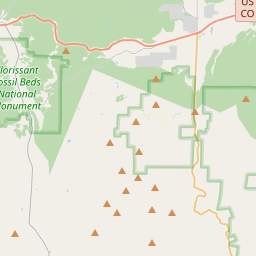

Key Colorado Springs Neighborhoods

Explore popular neighborhoods and their median home prices. Click on map markers for details.

Map Legend

Broadmoor

$850KLuxury, resort area

Old Colorado City

$400KHistoric, arts district

Briargate

$475KFamily-friendly, growing

Northgate

$500KNew development, families

Manitou Springs

$450KArtistic, mountain living

Colorado Springs Real Estate Market

Why Non-QM loans are popular in Colorado Springs

Military presence provides stable rental demand

Defense contractors create self-employed borrower population

More affordable than Denver with similar mountain access

Growing tech sector attracts remote workers

Colorado Non-QM Lending Articles

In-depth guides for Colorado Springs and Colorado borrowers

Frequently Asked Questions

Common questions about Non-QM loans in Colorado Springs

Are Non-QM loans available for Colorado Springs contractors?

Yes, bank statement loans and 1099 income loans are popular among defense contractors in Colorado Springs.