$525,000

Median Home Price

$425,000

Avg. Loan Amount

1.0M

Population

48+

Licensed Lenders

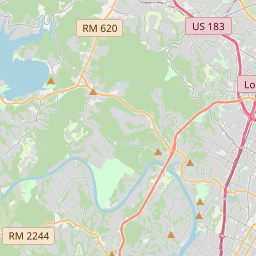

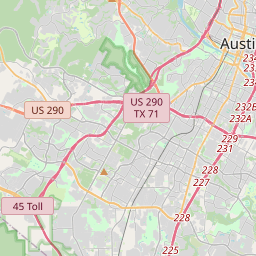

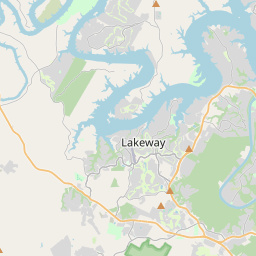

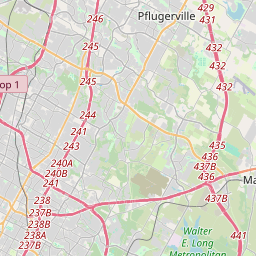

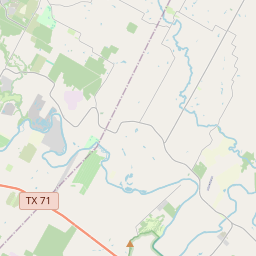

Key Austin Neighborhoods

Explore popular neighborhoods and their median home prices. Click on map markers for details.

Map Legend

West Lake Hills

$1.8MLuxury, tech executives

Downtown Austin

$650KUrban condos, young professionals

South Congress

$750KTrendy, creative professionals

Mueller

$550KNew development, families

Round Rock

$450KTech corridor, families

Cedar Park

$425KGrowing suburb, affordable

Austin Real Estate Market

Why Non-QM loans are popular in Austin

Tech industry boom creates many borrowers with stock-based compensation

Startup culture means many founders need bank statement loans

Strong rental demand from tech workers supports DSCR investments

Rapid appreciation makes investment properties attractive

Texas Non-QM Lending Articles

In-depth guides for Austin and Texas borrowers

Frequently Asked Questions

Common questions about Non-QM loans in Austin

How do Austin tech workers qualify for Non-QM loans?

Tech workers in Austin can use asset depletion loans to leverage their stock holdings, or bank statement loans if they have consulting income alongside their W-2 employment.

Are Non-QM loans available for Austin investment properties?

Yes, DSCR loans are very popular in Austin due to strong rental demand from tech workers. You can qualify based on the property's rental income.

Can startup founders get mortgages in Austin?

Absolutely. Bank statement loans allow startup founders to qualify using business bank statements showing cash flow, rather than tax returns that may show reinvested profits.